Insurance Advisory Newsletter – Professional Indemnity Insurance vis-a-vis Cyber Insurance : August 2024

Professional Indemnity Insurance And Cyber Insurance

As the usage of technology provides significant benefits to save time and effort, it has also resulted in an increase in claims pertaining to professional negligence and cyber-crime events. It is quite evident that without Professional Indemnity Insurance (“Professional Indemnity Insurance”) businesses can be exposed to significant legal and financial risk. A similar scenario can be seen in the case of the absence of Cyber Insurance (“Cyber Insurance”) as heavy usage of digital systems subjects business owners to potential exposure to cyberattacks.

Different businesses across sectors have unique insurance requirements. Not all businesses would require Professional Indemnity Insurance as a primary policy where exposure to third-party claims for errors and omission in services is minimal. On the other hand, Cyber Insurance will be applicable to all businesses that have digital footprints including websites, cloud systems, personal data storage, etc.

Professional Indemnity Insurance is specifically designed for businesses that provide professional service or advice. It offers protection in cases where a client alleges your professional negligence or breach of duty where professional service or advice caused damage, injury, or financial loss. To read more in detail about the inclusions and exclusions of Professional Indemnity Insurance, please refer to our earlier newsletter. Whereas Cyber Insurance covers the claims of third parties, fees, expenses, and legal costs arising from cyber incidents such as network security breaches, loss of client/employee data loss, or cyber-attacks. To read more in detail about the inclusions and exclusions of Cyber Insurance, please refer to our earlier newsletter.

Major Coverages Offered By Professional Indemnity Insurance & Cyber Insurance

| Professional Indemnity Insurance | Cyber Insurance |

| Triggered by Third-party legal liability claims | Triggered by both Third-party legal liability claims and first-party losses |

| Professional Negligence | Data Breach Responses |

| Breach of Duty | Business interruption loss |

| Legal Cost | Cyber Extortion |

| Defamation | Data Restoration |

| Loss of document | Incident response cost |

| Dishonesty of employee | System Damage and Restoration |

| IPR | Network Security Liability |

| Civil Liabilities | Privacy Liability and Media Liability |

| Breach of Confidentially | Regulatory Defence/Penalties |

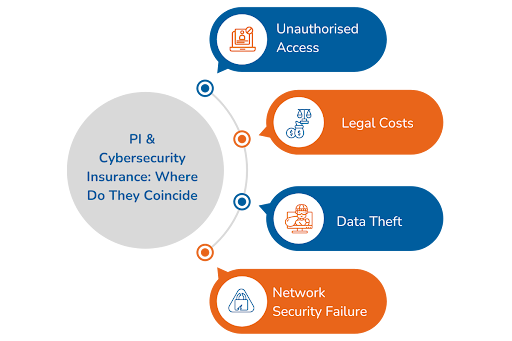

Incidences where both Professional Indemnity Insurance and Cyber Insurance can provide coverage once claims are proved

- Unauthorized Access – Where an IT company suffers cyber-attacks that cause damage to confidential information of 3rd party through inadvertent disclosure. In such a situation, damage and financial loss of 3rd party can be covered by the Professional Indemnity Policy caused due to professional negligence. Cyber Insurance policy will also be triggered on account of a breach of the IT network and system.

- Legal Costs – In the case of a software development company, a data breach of customer data occurs due to professional negligence, both Professional Indemnity and Cyber Insurance could trigger to cover the legal cost involved in order to defend the claim.

- Data Theft – In case 3rd party brings a claim against a company that holds its data and in case such data is altered, destructed or damaged due to a cyber attack, in such situation Professional Indemnity Insurance can trigger due to a breach of data and confidentiality obligations and cyber insurance can be a trigger for loss of data.

- Network Security Failure – Corruption of 3rd party network through the transmission of a computer virus can lead to a claim against the company that delivered the malware/virus. In such a scenario both Professional Indemnity Insurance and Cyber Insurance policies can respond to the claims. The latest and relevant example is of CrowdStrike crisis, where Professional Indemnity Insurance and Cyber Insurance both are likely to trigger. Essentially, the policies are triggered due to failure in preventing breach/mitigation of threats as well as larger-scale business interruption.