Employment Law Newsletter: SC Judgement in the EPFO vs Sunil Kumar Case – March 2023

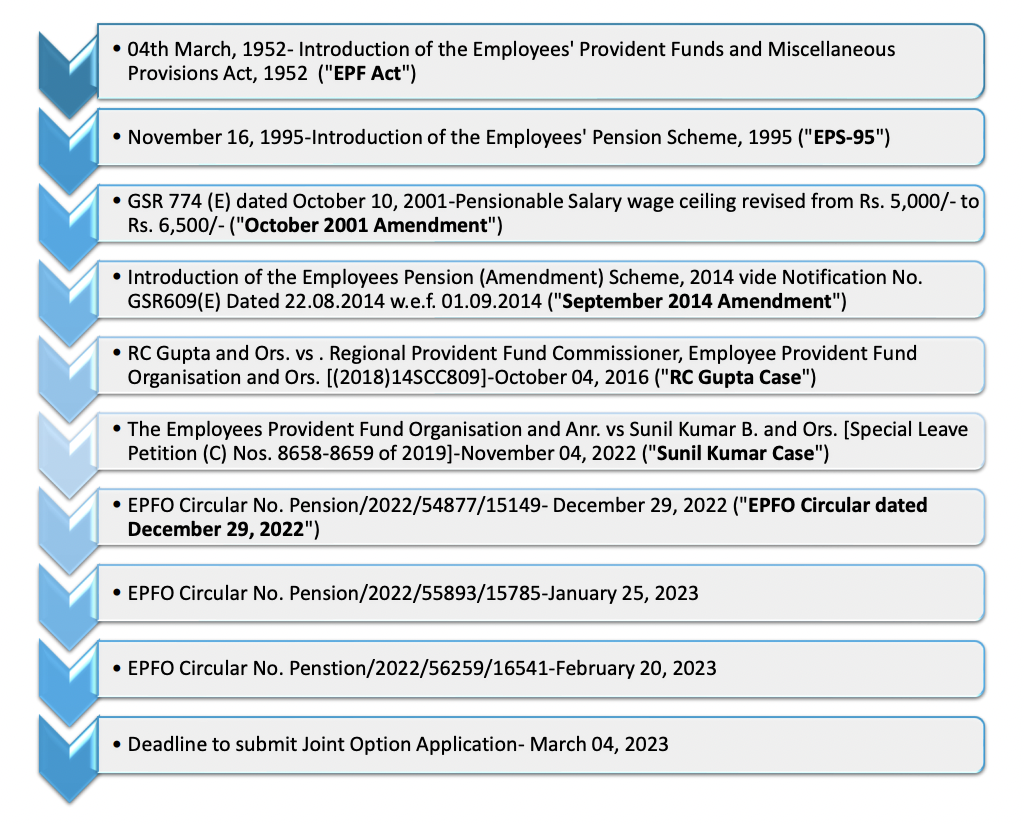

Timeline of Events

Background

What is EPS-95?

EPS-95 is a social security scheme focusing on providing pension benefits to employees in the organised sector.

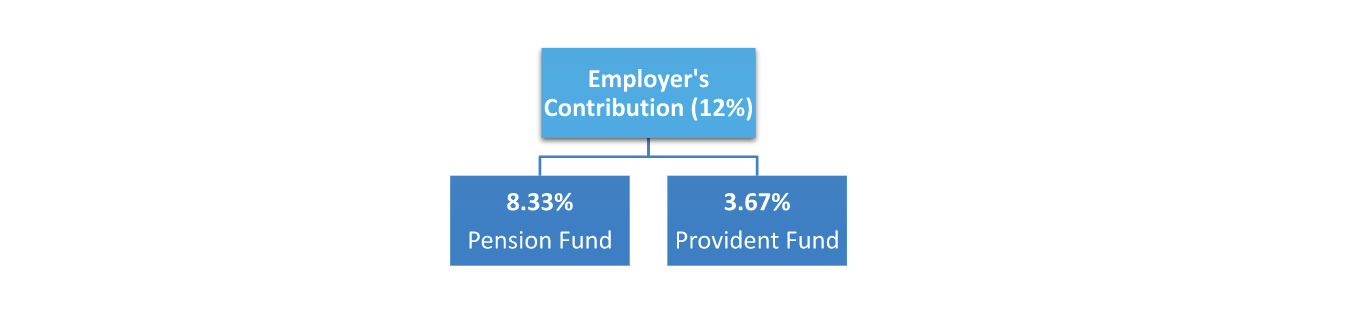

Mechanism of EPS Contributions

As per the EPF Act, both employers and employees are required to contribute 12% towards the provident fund of the employee. Further, as per Paragraph 3 of EPS-95, a part of the contribution representing 8.33% of the employee’s contribution shall be remitted by the employer to the Employees’ Pension Fund within 15 days of the close of every month by a separate bank draft or cheque on account of the Employees’ Pension Fund contribution.

Concept of Pensionable Salary Under EPS-95

Pensionable salary is the amount which a pensioner would receive from the day when he/she ceases to be a member of the Pension Fund.

From 1995 to October 2001 the pensionable salary was capped at Rs. 5,000/- which was revised to Rs. 6,500/- through the October 2001 Amendment to the EPS-95, which in turn also capped the contributions made by the employers to 8.33% of Rs. 6,500/-. However, the employees who intended to contribute a higher sum were allowed to do so, by their employer contributing @8.33% of such employee’s actual salary as per the proviso to Paragraph 11(3) of EPS-95. Such an option was being exercised with mutual consent between the employer and the employee (“Joint Option”).

Thereafter, vide the September 2014 Amendment to the EPS-95, the wage ceiling was further revised to Rs. 15,000/-. For the employees who were contributing a higher amount by exercising the Joint Option before September 01, 2014, were required to make a fresh application to the appropriate authority to continue to contribute on salary exceeding Rs. 15,000/- (“Fresh Option”). Such Fresh Option was required to be exercised by the member within 6 (six) months from September 01, 2014 (“Cut-Off Date”). Upon approval, such employees were also required to contribute at least 1.16% of their actual salary to the Pension Fund along with the employer’s contribution of 8.33% of the actual salary.

After the September-2014 Amendment, some employees continued to contribute at their higher salary without making a fresh application to the competent authorities within the Cut-off Date. As a result, the contribution in excess of 8.33% of Rs. 15,000/- made by the employer to the Pension Fund, was diverted to the Provident Fund of the concerned employee.

The aforementioned category of employees was aggrieved, as such employees were not able to avail the benefit of the option of contributing at their actual salary or a sum higher than the prescribed wage ceiling. Consequently, the matter reached the court on various occasions and as many as 54 writ petitions were filed by the employees.

RC Mehta Case (2016)

In this case, an appeal was filed in the Hon’ble Supreme Court against the order of the Division Bench of the Himachal Pradesh High court which (reversing the order of the Single Judge Bench of the same court) that the employees would not be entitled to the benefit of deposit of 8.33% of their actual salary in the Pension Fund irrespective of the ceiling limit. Accordingly, this appeal was allowed by the Supreme Court.

The Supreme Court in this case analysed whether the aggrieved employees would be eligible for the higher pensionable salary as their employers contributed the amount in the Pension Fund on their actual salary and not the prescribed wage ceiling.

Following was observed by the Supreme Court in this case:

- The Cut-Off Date is only for the calculation of Pensionable Salary and not the limitation on exercising of Joint Option.

- EPS-95 is a beneficial scheme, and therefore, its purpose should not be defeated by reference to a cut-off date, particularly in a situation where the employer had deposited 12% of the actual salary and not 12% of the prescribed wage ceiling.

- If both the employer and the employee opt for a deposit against the actual salary and not the ceiling limit, it should not foreclose the exercise of joint option under Paragraph 11(3) of the EPS-95.

Sunil Kumar Case (2022)

The September 2014 Amendment was held unconstitutional and invalid by the High Courts of Kerela, Delhi and Rajasthan (in the cases of P. Sasikumar & Others vs. Union of India (UOI) Represented by the Secretary to Govt. of India Ministry of Labour & Department of Employment and Others [in Writ Petition (C) No. 13120 of 2015], Bhartiya Khadya Nigam Karamchari Sangh and Anr. vs. Union of India and Ors. [in Writ Petition (C) No. 5678 of 2018]; and Union of India and Others vs. Jale Singh and Others [in D.B. Special Appeal Writ No. 436 of 2019], respectively). Therefore, the applicability of the September 2014 Amendment was in question which led to confusion.

In the Sunil Kumar Case, the Supreme Court addressed 54 such writ petitions under Article 32 of the Constitution of India as well as analysed the validity of the judgement of the Supreme Court in the RC Mehta Case (as summarised above) as the involved the same question of law.

In this case, Supreme Court observed the following:

- Relying on the judgment in the case of Bank of Baroda and Another vs. G. Palani & Others [(2022) 5 SCC 612] where it was held that pension is not a bounty but a right and such right cannot be taken away retrospectively, the Supreme Court stated that, existing members have been given the option to remain in the scheme even if their salary go beyond the ceiling limit. Thus, the right of such members to draw pension is protected.

- The September 2014 Amendment is legal and valid.

- The September 2014 Amendment shall be made applicable to the employees of exempted establishments in the same manner as applies to regular establishments.

- For the member who exercised the Fresh Option within the Cut-Off Date and continued to be in service as on September 01, 2014, will be guided by Paragraph 11(4) of the EPS-95.

- Upholding the judgment of the Supreme Court in the RC Mehta Case, Supreme Court held that:

- The members of the scheme, who did not exercise the Fresh Option (but were entitled to) within the Cut-Off Date due to the interpretation of the cut-off date by the authorities, would be entitled to exercise the Joint Option.

- The category of the aforementioned members has been given time to exercise Joint Option under Paragraph 11(4) of the EPS-95 within four months from the date of the judgments i.e., by March 04, 2023.

- The employees who retired before September 01, 2014, without exercising the Joint Option would not be entitled to the benefit as stated above or to exercise the Joint Option now.

- The employees who retired before September 01, 2014, after exercising the Joint Option shall be covered under Paragraph 11(3) of the EPS-95 and be entitled to get the benefits of the higher contribution accordingly.

- The additional 1.16% required to be contributed as per the September-2014 Scheme is ultra-vires for the purpose of the EPF Act, therefore, the employees are only required to contribute such an additional amount up until May 04, 2023, the whereafter such contribution should stop from the employee’s end and be adjusted as per the directions of the legislature in this regard.

Directions under the EPFO Circular dated December 29, 2022

Among other things, the following has been directed by the Employees’ Provident Fund Organisation (EPFO) vide the Circular dated December 29, 2022:

- All Regional EPF Offices have been directed to comply with the Judgment of the Supreme Court in the Sunil Kumar Case.

- Who is eligible (“Eligible Employees”)?

- The employees who had contributed on salary exceeding the prevalent wage ceiling of Rs. 5,000/ or Rs. 6,500/- (as the case may be); AND

- Exercised the Joint Option before the September 2014 Amendment while continuing to be members post-September 01, 2014; AND

- their exercise of such a Joint Option was declined by the PF authorities.

Broad eligibility criteria are summarised below:

| Category of Employees | Eligibility

(For exercising Joint Option) |

| Employees who retired before September 01, 2014, without exercising the Joint Option | Not eligible |

| Employees who retired before September 01, 2014, after having exercised the Joint Option | Eligible |

| Employees who retired after September 01, 2014, but could not exercise the Joint Option within the Cut-Off Date, yet continued contributing 8.33% of their actual salary and not the wage ceiling till their retirement | Eligible |

| Employees who have not retired yet, were members before September 01, 2014, and exercised Joint Option as per the mechanism prevalent before September 01, 2014, and could not exercise the Joint Option within the Cut-Off Date as per the regime prevalent after September 01, 2014, yet continue to contribute at their actual salary and not the wage ceiling | Eligible |

| Those who are contributing towards EPF on statutory limit i.e., Rs 5000/- or Rs 6500 or Rs 15000/- | Not eligible |

| Those who became members of EPFO after September 01, 2014 | Not eligible |

| Those employees who made higher contributions till September 01, 2014, on Rs. 6,500/- and thereafter, stopped contributing such higher sum on their actual salary, rather, contributed on the wage ceiling of Rs. 15,000/-, without any rejection by the EPF authorities | Not eligible |

- What are the Eligible Employees required to do?

All the Eligible Employees are required to make an application digitally or online at www.epfindia.gov.in for validating their options (“Joint Option Application”), if any, by the concerned Regional Office by March 04, 2023, in the manner as prescribed under the said Circular.

- What should be submitted along with the Joint Option Application Form?

- Proof of joint option under Para 26(6) of the EPF Scheme duly verified by the employer; and

- Proof of joint option under the proviso to erstwhile Para 11(3) duly verified by the employer; and

- Proof of remittance in Provident Fund on higher wages exceeding the prevalent wage ceiling of ` 5000/6500; and

- Proof of remittance in Pension Fund on higher wages exceeding the prevalent wage ceiling of ` 5000/6500, if any; and

- Written refusal of Assistant Provident Fund Commissioner (APFC) or any other higher authority of EPFO to such requests/remittance.

- What will be the treatment of Contributions made under the PF Trust by Exempted Establishments?

Exempted establishments under Section 17 of the EPF Act are required to transfer the funds from the provident fund trust made under the provisions of the EPF Act to the Pension Fund of the EPFO.

The employees of such exempted establishments will be required to obtain an Undertaking from the trustee of the said provident fund trust. In such an Undertaking, the concerned trustee should state that a due contribution along with interest up to the date of payment will be deposited in the specified period.

FAQs

What is the action on employers?

- All employers registered with the EPFO have been provided separate login credentials and all the employees’ Joint Option Applications will land in the employer’s EPFO account.

- The pre-requisite as per the aforementioned EPFO Circular dated December 29, 2022, for submission of the Joint Option Application form is verification by the respective employer of the exercise of Joint Option followed by contribution on the actual salary as opposed to the wage ceiling. Therefore, the verification through a digital signature will be essential for further processing of the Joint Option Application by the EPFO authorities.

- On a conjoint reading of (1) and (2) above:

i) Employers are required to keep a close watch (using their login credentials provided by EPFO) on all Joint Option Applications made by Eligible Pensioners.

ii) Upon receipt of the Joint Option Application, the employer shall digitally verify before March 04, 2023, the following:

a) Proof of joint option under Para 26(6) of the Employees’ Provident Fund Scheme, 1952; and

b) Proof of joint option under the proviso to erstwhile Paragraph 11(3) of EPS-95 - Exempted establishments will be required to give an Undertaking stating that a due contribution (for the funds diverted to the provident fund) along with interest up to the date of payment will be deposited to the EPFO account of the employee by March 04, 2023. This Undertaking is in addition to the verification as specified above.

What is the method of deposit and computation of diverted funds?

The method for deposit and computation of diverted funds is awaited and is speculated to be addressed by the EPFO authorities in the coming months.

What about the employees who became members of the EPFO after September 01, 2014?

The provision for Fresh Option under Paragraph 11(4) of the EPS-95 was only for the members who were members of the EPFO before September 01, 2014, and continued to be so after such date. Therefore, such category of employees who have become a member of the EPFO after September 01, 2014 – and cannot exercise the Joint Option as prescribed by the Supreme Court in the Sunil Kumar Case.

For further clarification, the relief in the Sunil Kumar Case is for the employees who could not avail of the benefit of the Joint Option despite contributing the higher sum in the Pension Fund and their applications for receiving higher pensionable salary were rejected by the EPFO authorities for they failed to exercise Fresh Option within the Cut-Off Date as per the September 2014 Amendment.