Insurance Advisory Newsletter – Commercial Crime Insurance and Cyber Insurance : November 2024

Does Commercial Crime Insurance And Cyber Insurance Overlap?

In today’s rapidly evolving business landscape, companies face an increasing range of risks, particularly from commercial crime and cyber threats. Commercial Crime Insurance protects companies from the losses resulting from direct loss of money, securities and other property of the companies arising out of employee theft and /or third-party fraud and dishonesty (“Crime Insurance”). Crime Insurance can also cover the claims of computer fraud. Cyber insurance is a type of coverage that helps businesses manage the financial risks associated with cyberattacks and data breaches (“Cyber Insurance”).

Determining whether a business needs Crime Insurance or Cyber Insurance largely depends on the nature of its operations and the specific risks it faces. While larger organizations may benefit from both types of insurance to fully safeguard their assets, smaller businesses or those with a more traditional business model may find one type of coverage more relevant depending on their specific vulnerabilities. However, it is prudent to maintain both Crime Insurance and Cyber Insurance to reduce the risk exposure.

Crime Insurance helps safeguard a company’s assets and operations from any financial exposure caused by criminal acts. To read more in detail about the inclusions and exclusions of Commercial Crime Insurance, please refer to our earlier newsletter. Cyber Insurance covers the claims of third parties, fees, expenses and legal costs arising from cyber incidents such as network security breaches, loss of client/employee data loss or cyber-attacks. To read more in detail about the inclusions and exclusions of Cyber Insurance, please refer to our earlier newsletter.

Important Coverages Offered By Crime Insurance & Cyber Insurance

| Crime Insurance | Cyber Insurance |

| First Party and Third Party Losses | First Party and Third Party Losses |

| Employee Dishonesty | Data Breach Responses |

| Premises and Transit | Business interruption loss |

| Care, Custody and Control | Cyber Extortion |

| Expectation Damage | Privacy Liability and Media Liability |

| Computer Fraud | Network Security Liability |

| Depositors Forgery | Regulatory Defence/Penalties |

| Insured’s Legal Liability | Data Restoration |

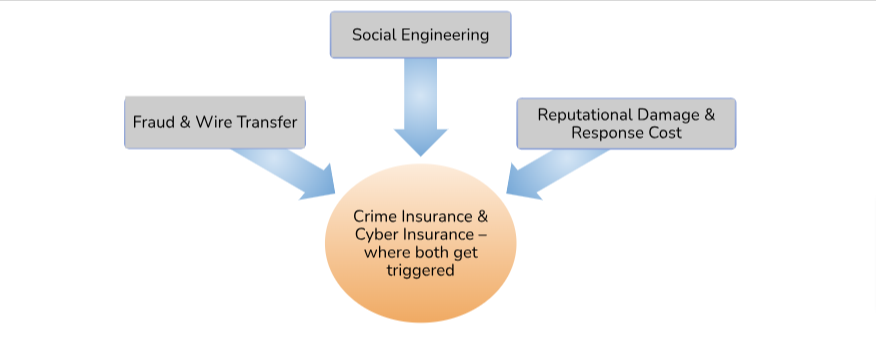

Incidences where both Crime Insurance and Cyber Insurance can offer coverages and the trigger events of overlap

- FRAUD THROUGH WIRE TRANSFER: In the event a company experiences a cyberattack, wherein the hackers gain access to their internal network and use the access to initiate fraudulent wire transfers. In such case, Cyber Insurance will cover the expenses of recovering the stolen data, restoring systems and handling the breach. While Crime Insurance would cover the financial loss from the fraudulent transfers initiated by the hacker, especially if they were able to bypass internal records.

- SOCIAL ENGINEERING: Social engineering is a cybersecurity threat that involves manipulating people into sharing sensitive information through psychological manipulation. However, Social Engineering incident could potentially be covered by either Crime Insurance or Cyber Insurance or both.

REPUTATIONAL DAMAGE AND RESPONSE COST: Cyber Insurance cost for crisis management, public relations efforts and customer notification in the event of a data breach as well as other cyber incidents. Crime Insurance could similarly provide support for addressing the significant financial losses that damage the company’s reputation or trust with clients.